Santander Pay In Cheque App Uk

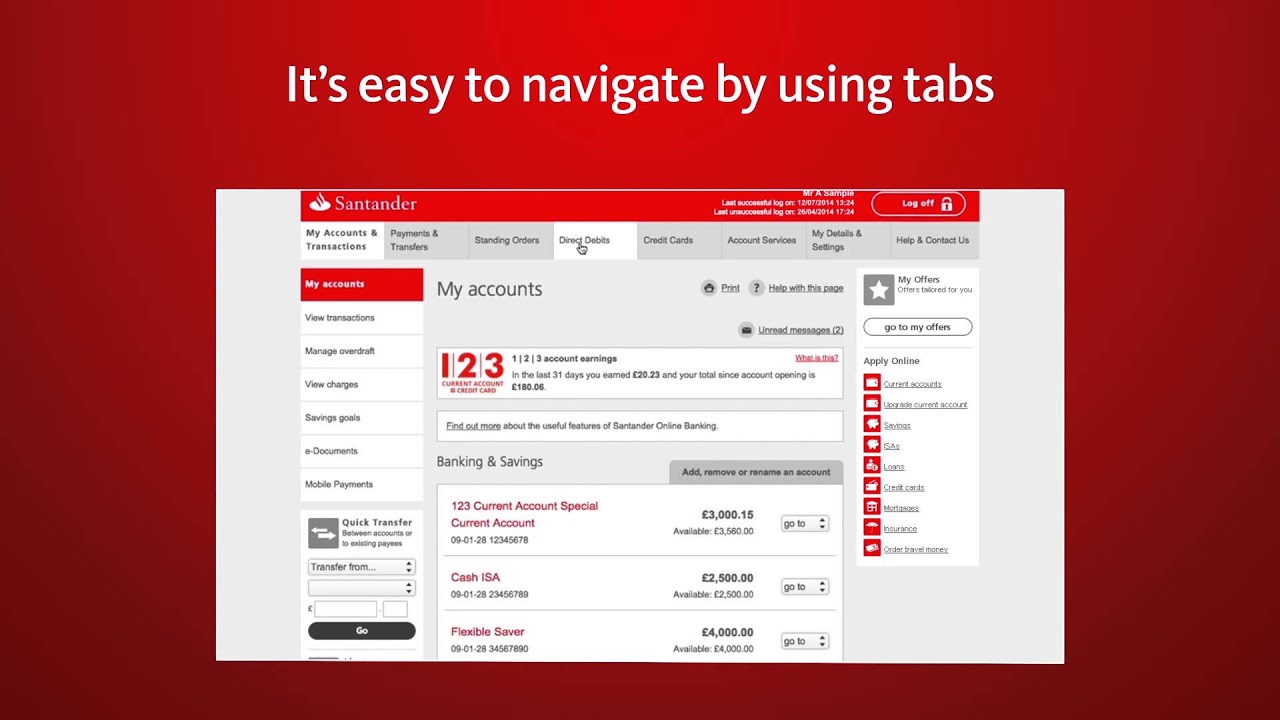

Pay in cheques by using the Barclays app and your smartphone’s camera 1. Just take a photo of the cheque and submit it through your app, with the amount and payee details. Just take a photo of the cheque and submit it through your app, with the amount and payee details. Discover the new design and functions of the new Santander App. Your bank, open 24h a day, 365 days a year: In addition to the new enhanced design and browsing features, you can: CHECK YOUR BALANCES, TRANSACTIONS AND EXPENSES Check the balances and transactions of all of your products quickly and easily. You can now also filter and search for transactions by text (New) Check your total.

When you’re on the go, it can be hard to fit everything you need to get done between 9 and 5. Even if you don’t work traditional hours, you can’t always drop everything and get to a branch or an ATM to do your banking.

It’s time to bank on your own terms. With the Santander Mobile Banking App you can take care of many of your banking needs, whenever it best fits into your schedule. Here are 5 (out of many!) ways that the Santander Mobile Banking App1 can make your life and banking simpler:

1. Quick Balance Check

When you’re in a rush, you want to cut out as many unnecessary steps as possible. We understand. Because of that, you can view the balance of up to 3 selected accounts without even having to log in to your account. So if you’re in line at the store or writing a check and want to make sure you have enough in your account, you won’t have to wait to see your balances.

2. Mobile Fund Transfers2

After checking your balances, if one of your accounts is low, you can easily transfer funds from one account to another account. Just open the app, select Transfers from the menu, swipe to choose your “To” and “From” accounts, and enter the amount you want to transfer.

Learn more about Mobile Transfers.

3. Mobile Check Deposit3

Have a check to deposit? It can be easy to let it sit around for several weeks until you can get to a branch or an ATM. Don’t wait. Open the mobile deposit feature of the app, take a picture of both sides of the check (make sure you sign it first!), and confirm your deposit.

Learn more about Mobile Check Deposit.

4. Mobile Bill Payments

Forget to pay one of your bills, or don’t have time to log on to your computer? If you’ve already set up a biller through Online Banking, you can pay the bill directly from your phone. Just open up the BillPay tab in your app and select the bills you need to pay.

Learn more about Mobile BillPay.

5. Customer Service

Have a question? There is an extensive FAQ section available in the mobile banking app, with information about features and answers to other banking questions.

If you’d like to speak to an expert, your Santander Mobile Banking App can help too. You can easily find the location of your nearest branch or contact our customer service center.

Ready to simplify the way you bank? Learn more about Mobile Banking and how to download the Santander Mobile Banking App.

1 To use the Santander Mobile Banking App, you must first enroll and log in to Online Banking and accept the Online Banking Agreement. Message and data rates may apply.

2 You can withdraw funds from your savings or money market savings account no more than 6 times by computer, telephone, preauthorized transfer, check, or Debit Card purchase each service fee period. Fees apply if you exceed these limits, and if you repeatedly exceed these limits, we will close your account or convert your account to a checking account.

3 Mobile deposits are subject to limits and other restrictions. Refer to the Online Banking Agreement for details.

You’re already doing pretty much everything on your phone, whether it’s connecting with friends or colleagues or paying bills through your mobile banking app. But are you using mobile check deposit?

There are many benefits to utilizing the mobile check deposit functionality – we’ve listed out top three below.

1. Because your time is important.

Your time is valuable, and unless you need to talk to a banker about other financial concerns, you don’t want to waste yours getting to a bank branch or ATM. Depositing your check by phone is fast, and can be done almost anywhere – as long as you have cell service or Wi-Fi!

2. Because you don’t want overdraft fees.

Look, nobody likes fees. If you’re not able to get to the bank in the near future but you still have expenses coming up, like your rent or your monthly Netflix payment, now’s the time to mobile deposit any outstanding checks you have. That way you’ll have enough time to get funds into your account, and hopefully avoid any overdraft fees when it comes time to make your next payment.

Not sure if your balance is low? You can go ahead and set up mobile alerts to make sure you’re always informed.

3. Because you’re on the go.

Even if you’re out of town, that doesn’t mean your bank account is out of reach. Maybe you’re visiting family for the holidays and you got a check from your favorite aunt. Or, you’re attending a school far from home and somebody paid you by check. You don’t want to wait to get home to be able to access your cash! Even if you’re not in the same ZIP code as your bank, it doesn’t mean you have to put your life on hold. Use mobile deposit to get your funds, faster.

How long does mobile deposit take?

Mobile check deposit takes only a few minutes. But there is processing time involved, just like any deposit. If you’re banking with Santander, when you deposit a check before 10 pm on a business day, it counts as being deposited on that day. You’ll be able to access up to $200 of the amount you deposited the next business day, however you won’t be able to access the rest of the deposit amount until the check clears. This usually happens within two business days of the deposit.

How does mobile deposit work?

Pay Cash Cheque

Mobile deposit works simply—just point, click and confirm. Take a picture of your check through your bank app and click through the steps on screen. You’re all done! Learn how to download our app and get started with Santander mobile check deposit.