Icici Bank Fixed Deposit Rates

Interest rates differ from bank to bank, and rates for Indian citizens, Hindu Undivided Family (HUF) also vary; Tax Saving FDs can be held in a single or a joint mode. If it’s a joint Tax Saving Fixed Deposit, tax benefits are available only to the first account holder. Advantages of Tax Saving Fixed Deposits compared to other Section 80C. The ICICI Bank FD rates for fixed deposits more than 5 years is 0.30% extra per annum. The senior citizen residents of India will get additional ICICI Bank FD rates of 0.30% for a specific period above than the. Interest rates effective from 9th November 2020. FAQs about Fixed Deposit Which bank is offering the highest fixed deposit interest rates? Currently, North East Small Finance Banks is offering the highest FD interest rate of 7.50%, for the tenure of 730 days to less than 1095 days.

- Icici Bank Fixed Deposit Rates

- Icici Bank Fd

- Fixed Deposit Rates Of Icici Bank

- Icici Bank Fixed Deposit Rates Singapore

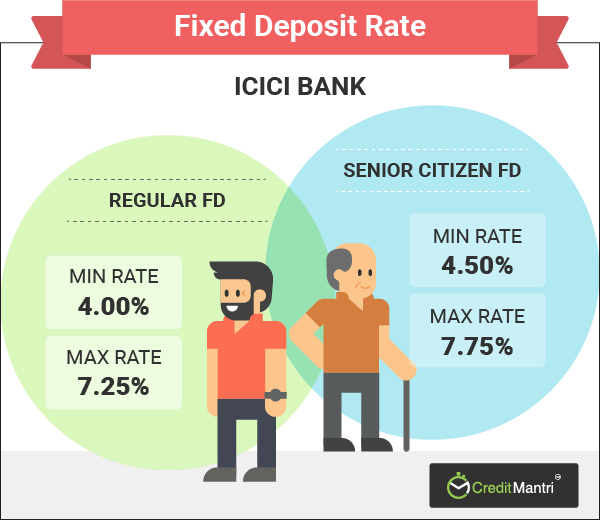

- Icici Bank Fixed Deposit Rates For Senior Citizens

ICICI Bank has FDs that have tenures starting from 7 days and extending to one year and up to 10 years.

India’s largest private sector bank, ICICI Bank on Wednesday announced its latest rates of interest on fixed deposits. The Reserve Bank of India has been cutting down the interest rates which primarily apply to the lending undertaken by banks. The banks have to adjust the rates of interest they pay their customers as their earnings from lending will be impacted by the rate cuts announced by RBI.

ICICI Bank Fixed Deposit Interest Rates. Maturity period Interest rate with effect from June 16; Public: Senior citizen: Seven to 14 days: 2.75%: 3.25%: 15 to 29 days: 3.00%: 3.50%: 30 to 45 days. ICICI Bank Fixed Deposit Interest Rates. ICICI Bank is the largest bank in private sector in India. It provides its retail and corporate customers with all the financial and banking services. It's headquarter is located in Gujarat. Its subsidiaries can be found in many other countries. The rates offered on FDs by the bank are very competitive.

ICICI Bank has FDs that have tenures starting from 7 days and extending to one year and up to 10 years. The interest on these also follow the curve and as the tenures increase, so do the rates. Senior citizens will continue to enjoy a 50 basis points higher rate at each of these slabs.

The latest rates of interest offered by ICICI Bank effective August 14 would be as below:

For deposits with duration of 7 to 14 days, the interest will be 4% pa. It is 4.25% if the amounts deposited have a maturity period ranging between 15 and 29 days and 5.25% between 30 and 45 days and 5.75% for maturity between 46 and 60 days.

Fixed deposits with ICICI Bank for deposits of three slots, 61-90, 91 to 120 and 121 to 184, all these will earn a uniform rate of 5.75%. For FDs beyond 185 days and up to 289 days, it will be 6.25% and from 290 days to less than a year, it will be 6.50%.

These rates then gradually inch up to 7% per annum as the maturity periods increase from one year to 389 days and then on to 18 months and then 2, 3 and 5 years. The last 5 years and 1 day to 10 years, the interest rate is 7% while in some of the shorter ones, like the 2- and 3-year fixed deposits, one can earn 7.1%.

As mentioned earlier, all these rates represent what a normal depositor would get. Senior citizens will be eligible for an additional 0.50% in each case.

Then there is the 5-year tax saving fixed deposit in which an individual can save up to a maximum of Rs 1.50 lakh. This deposit too will be entitled to a return of 7% interest beginning today, August 14.

Show us some love! Support our journalism by becoming a TNM Member - Click here.

© Jocelyn Fernandes Fixed Deposit rates: Check out FD interest rates in SBI, ICICI Bank, HDFC Bank PNB and Axis BankFor tenures ranging from 7 days to 10 years, top banks like State Bank of India (SBI), HDFC Bank, Punjab National Bank (PNB), ICICI Bank and Axis Bank offer fixed deposits (FDs). Before parking your money any FD deposit, it's always important to compare the FD interest rates offered by various banks.

This month SBI and Axis Bank revised the interest rates on term deposits. Check out the latest fixed deposit rates in SBI, ICICI Bank, HDFC Bank, PNB and Axis Bank.

FD interest rates SBI (below Rs 2 crore) effective January 8, 2021:

SBI FDs between seven to 45 days will now fetch 2.9 percent. Term deposits between 46 days to 179 days will give 3.9 percent. FDs of 180 days to less than one year will fetch 4.4 percent. Deposits with maturity between 1 year and up to less than 2 years will give 10 bps more now. These deposits will fetch an interest rate of 5 percent instead of 4.9 percent. FDs maturing in 2 years to less than 3 years will give 5.1 percent. FDs with 3 years to less than 5 years will offer 5.3 percent and term deposits maturing in 5 years and up to 10 years will continue giving 5.4 percent after the latest revision.

Days

Interest rates

7 days to 45 days

2.9%

46 days to 179 days

3.9%

180 days to 210 days

4.4%

211 days to less than 1 year

4.4%

1 year to less than 2 years

5%

2 years to less than 3 years

5.1%

3 years to less than 5 years

5.3%

5 years and up to 10 years

5.4%

FD interest rates Axis Bank (below Rs 2 crore) effective January 4, 2021:

Across different tenures, Axis Bank offers FDs ranging from 7 days to 10 years. The bank gives interest on FDs ranging from 2.5 percent to 5.50 percent for general customers. On select maturities, Axis Bank offers a higher interest rate to senior citizens. The bank offers interest ranging from 2.50 percent to 6 percent to senior citizens.

Days

Interest rates

7 days to 29 days

2.5%

30 days to 90 days

3%

90 days to 120 days

3.5%

120 days to 180 days

3.75%

180 days to 360 days

4.40%

2 years to less than 3 years

5.4%

3 years to less than 5 years

5.4%

Icici Bank Fixed Deposit Rates

5 years and up to 10 years

5.5%

FD interest rates Punjab National Bank (below Rs 2 crore) effective January 1, 2021:

On fixed deposits maturing in the range of 7 days to 10 years, PNB is offering an interest rate ranging between 3 percent and 5.30 percent. On 7-45 days fixed deposits, PNB is offering an interest rate of 3 percent and it goes up 4.5 percent on less than 1 year FDs. PNB gives 5.20 percent interest on term deposits maturing in one year to up to 3 years. On deposits maturing above 5 years to 10 years, PNB is offering 5.30 percent interest. The Senior citizens shall get an additional rate of interest of 50 bps over applicable card rates for all maturities on domestic deposits of less than Rs 2 crore.

Days

Interest rates

7 days to 45 days

3%

46 days to 90 days

3.25%

91 days to 179 days

4%

180 days to 270 days

4.4%

271 days to less than 1 year

4.5%

1 year to 3 years

5.2%

3 years to 5 years

5.3%

5 years and up to 10 years

5.3%

FD interest rates HDFC Bank (below Rs 2 crore) effective from November 13, 2020:

On deposits between 7 days and 29 days, HDFC Bank offers a 2.50 percent interest rate. 3 percent on deposits maturing in 30-90 days. On 91 days to 6 months, 3.5 percent and on 6 months 1 day to less than one year, 4.4 percent. The bank gives 4.9 percent on FDs maturing in one year. Term deposits maturing in one year and two years will fetch an interest rate of 4.9 percent. FDs maturing in 2 years to 3 years will give 5.15 percent, 3 years to 5 years will give 5.30 percent. Deposits with a maturity period of 5 years to 10 years will give 5.50 percent interest.

Days

Interest rates

7 days to 29 days

2.5%

30 days to 90 days

3%

91 days to 179 days

3.5%

180 days to 365 days

4.4%

365 days to less than 2 years

4.9%

2 years to 3 years

5.15%

3 years to 5 years

5.3%

5 years and up to 10 years

5.5%

FD interest rates ICICI Bank (below Rs 2 crore) effective from October 21, 2020:

ICICI Bank gives 2.5 percent interest on deposits maturing in 7 days to 29 days, 3 percent for 30 days to 90 days, 3.5 percent for FDs maturing in 91 days to 184 days. On deposits maturing in 185 days to less than 1 year, ICICI Bank gives an interest rate of 4.40 percent. Term deposits maturing in 1 year to less than 18 months will fetch an interest rate of 4.9 percent. Now, FDs with tenure of 18 months to 2 years will give you 5 percent interest. Term deposits maturing in 2 years to 3 years will give 5.15 percent, 3 years to 5 years 5.35 percent, and 5 years to 10 years 5.50 percent.

Days

Interest rates

7 days to 29 days

2.5%

30 days to 90 days

3%

Icici Bank Fd

91 days to 184 days

3.5%

185 days to 365 days

4.4%

1 year to less than 1.5 years

4.9%

Fixed Deposit Rates Of Icici Bank

1.5 years to 2 years

5%

2 years to 3 years

Icici Bank Fixed Deposit Rates Singapore

5.15%

3 years and up to 5 years

5.35%

Icici Bank Fixed Deposit Rates For Senior Citizens

5 years to 10 years

5.5%