Cheque Deposit

Federal law mandates that all Federal benefit payments – including Social Security and Supplemental Security Income benefits – must be made electronically.

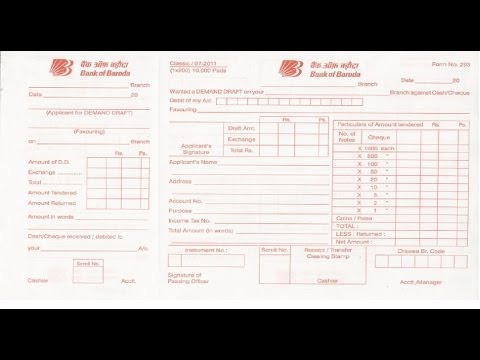

Visit a branch: You can also deposit checks in person at one of your bank’s branches. An advantage of depositing with a teller is that more of your money might be available quickly. Deposits with bank. The check that you will deposit in your account is called a third-party check. It was made out to your friend, but he endorsed it to your name, so you can deposit it to your bank. Several factors also come.

There are two ways you can receive your benefits:

- You can deposit a cheque into your account from anywhere by taking a picture of it using an app on your smart phone or tablet. Many financial institutions in Canada now offer this service. This process is.

- Sign the back of the check and write “for deposit only at Bank of America”. Take photos of the front and back of the check with your smartphone — just select the Front of Check and Back of Check buttons. Select the account to receive the deposit, enter the amount and tap Continue. After confirming the details, tap Deposit.

- With Chase QuickDeposit, our remote deposit solution, you just scan your paper checks and send the scanned images electronically or through mobile deposit to Chase for deposit into your checking.

- Into an existing bank account via Direct Deposit or

- Onto a Direct Express® Debit Mastercard®

Cheque Deposit Maybank

Direct Deposit is the best electronic payment option for you because it is:

- Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen.

- Quick – It's easy to receive your benefit by Direct Deposit. You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax. Your benefit will go automatically into your account every month. And you'll have more time to do the things you enjoy!

- Convenient – With Direct Deposit, you no longer have to stand in line to cash your check when it arrives. Your money goes directly into your account. You don't have to leave your house in bad weather or worry if you're on vacation or away from home. You don't have to pay any fees to cash your checks. Your money is in your account ready to use when business opens the day you receive your check.

If you are applying for Social Security or Supplemental Security Income benefits, you must elect to receive your benefit payment electronically when you enroll. If you currently receive Social Security or Supplemental Security Income benefits by check, you must switch to an electronic payment option listed above.

To learn more about how to easily switch from a paper check to an electronic payment option, visit Treasury’s Go Direct website or call the Treasury’s Electronic Payment Solution Center at 1-800-333-1795. You can also create a mySocial Security account and start or change Direct Deposit online.

Cheque Deposit Kiosk

In extremely rare circumstances, Treasury may grant exceptions to the electronic payment mandate. For more information or to request a waiver, call Treasury at 855-290-1545. You may also print and fill out a waiver form and return it to the address on the form.

Cheque Deposit Posb

If you have any questions, call Social Security at 1-800-772-1213 (TTY 1-800-325-0778).