Chase Bank Direct Deposit

- Chase Bank Direct Deposit Name

- Chase Bank

- Chase Bank Direct Deposit Information

- Chase Bank Direct Deposit Routing Number

The Chase bank direct deposit form is a standard and legal form that becomes effective once it is signed. The purpose of this form is to grant the necessary authorization for your Employer and Chase Bank to set up a Direct Deposit of funds into a Chase Bank Account of your choosing when it is time for the Employer to pay you. The rate and frequency of these Deposits will be strictly up to you and your Employer. Additionally, your Employer may also have their own procedures set in place to set up Direct Deposit Payments. Generally, it is expected that you will have a clear line of communication with your Employer regarding such matters before filling out and submitting this form to the Payroll Department in your place of employment.

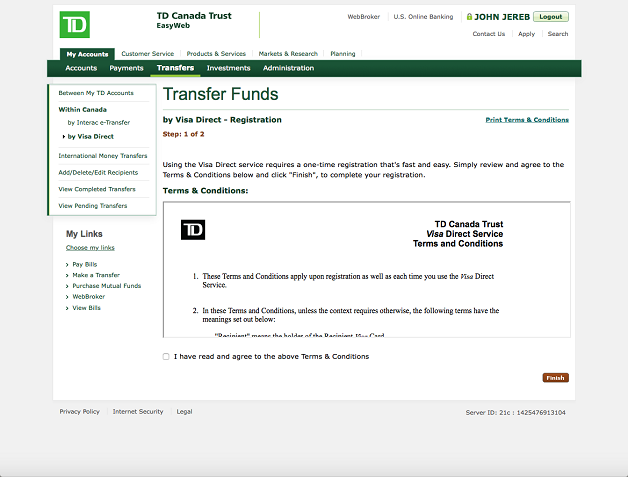

'Chase Private Client' is the brand name for a banking and investment product and service offering. Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Here’s how to set up direct deposit with Chase. Step-By-Step Instructions: Log in to your Chase account online or through the mobile app. Navigate to “Account Services,” tap “Set up direct deposit form” and download the pre-filled Chase direct deposit form. Alternatively, download and fill out the Chase direct deposit form.

Step 1 – Download the document from the button labeled “PDF” on the right side of this page. When you are ready, you may either open it to enter information or print it to enter information.

Step 2 – Read the information on the left side of the page then, when you are ready, report the Account Holder/Recipient Name on the blank line labeled “Customer Name.” Below this, use the “Address” line to enter the Chase Account Holder’s Street Address. On the next line, report the City, State, and Zip Code associated with the Chase Account Holder’s Street Address.

Step 3 – Next you must define the Type of Account you would like your compensation to be directly deposited to. If this will be a Checking Account, then mark the check box labeled “Checking Account Number” and enter your Account Number on the blank line above these words. If this is a Savings Account, then check the box labeled “Savings/MIA/Money Market Account Number” and enter your Account Number on the blank line just above these words. Only one of these boxes may be checked and the Account Number must be present on the blank line associated with that check box.

When does a direct deposit hit your account? Direct deposits arrive in accounts no later. Investment and insurance products are:. not fdic insured. not insured by any federal government agency. not a deposit or other obligation of, or guaranteed by, jpmorgan chase bank, n.a. Or any of its affiliates. subject to investment risks, including possible loss of the principal amount invested. Below is a list of banks, along with what they’ll count as a direct deposit. This is useful information because a lot of bank sign up bonuses require you to make direct deposits to receive the sign up bonus. Changing where your paycheck is deposited can be frustrating and time consuming.

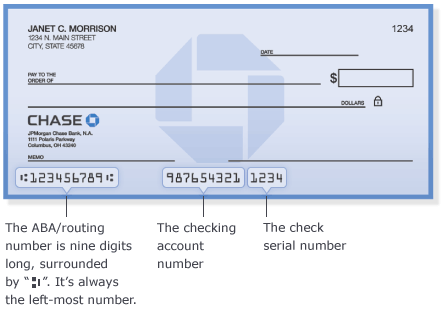

Step 4 – Report your Chase Bank Branch’s Routing Number on the blank line labeled “Bank’s Routing Number.” If you are unsure, you may find the Routing Number on your personal check. It is the nine digit number on the bottom left. Otherwise contact your branch directly for this number.

Step 5 – On the blank line in the statement beginning with the words “I authorize…,” enter the Name of the Employer or Paying Entity that you are allowing to make regular deposits into the Account defined in Step 3.

Step 6 – Sign your Name on the line labeled “Customer Signature” then, enter the Signing Date just above the word “Date.”

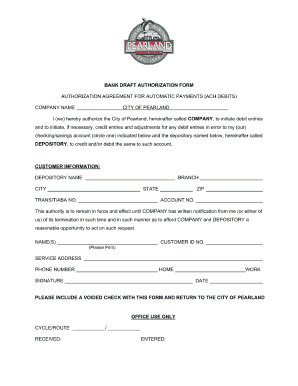

Step 7 – Submit this form to the Payroll Department in your Employer’s Company. Some Payroll Departments may require additional paperwork such as a blank voided check so make sure to contact them first regarding the procedure they have set in place.

Chase Bank Direct Deposit Name

Chase Bank

Those looking to enjoy instantaneous deposits of funds into their Chase Bank checking or savings account will be required to employ the Chase Bank direct deposit authorization form. The form requires very little in the way of information but it must, once completed, be accompanied by a voided check and delivered to the Chase customer’s payroll officer/employer. Be sure to have your routing number (list linked below) and your account number on hand before downloading and filling in the form.

Step 1 – To get started, download the form and open it up in your web browser or PDF viewer. You may choose to complete it online or fill it in by hand.

Chase Bank Direct Deposit Information

Step 2 – Start off with your name. Enter it into the first field at the top and then provide your full home address in the remaining fields.

Step 3 – Next, you’re going to need to enter in your bank account information to provide your employer with the means to directly deposit your paychecks. Choose between your checking account and your savings account. Next, enter in the account number followed by your bank’s routing number.

Chase Bank Direct Deposit Routing Number

Step 4 – Before printing off the document, provide your authorization by giving the name of the business at which you are employed. Note that the authorization will remain in effect, as stated, until written notice has been provided by you and you alone. Enter in the date before printing off the form, signing it, and delivering it to your payroll department with a voided check in tow.