Andhra Bank Savings Account Interest Rate

- Andhra Bank Savings Account Interest Rate Calculator

- Andhra Bank Savings Account Interest Rate

- Andhra Bank Savings Account Interest Rate Per Month

- What Is The Interest Rate In Andhra Bank

Andhra Bank savings account comes with interest rates of up to 4%, depending on the daily balance, and the type of account. Do keep in mind that the rates are subject to change at the sole discretion of the bank. Andhra Bank Savings Account Charges Different Andhra Bank savings accounts have a different schedule of charges. Indian Private Sector Bank. Note: Reserve Bank of India has deregulated interest rates on savings accounts in India in October 2011. Before the deregulation, all banks offered the same interest rate of 4.00% on savings accounts. The interest rate is also dependent on whether you opt for the fixed or the floating interest rate. Depending on the loan product the interest rate could be either high or low. Existing bank customer: If you are already a savings account holder with Andhra Bank then the bank may offer you a lesser interest rate. This is in view of your past.

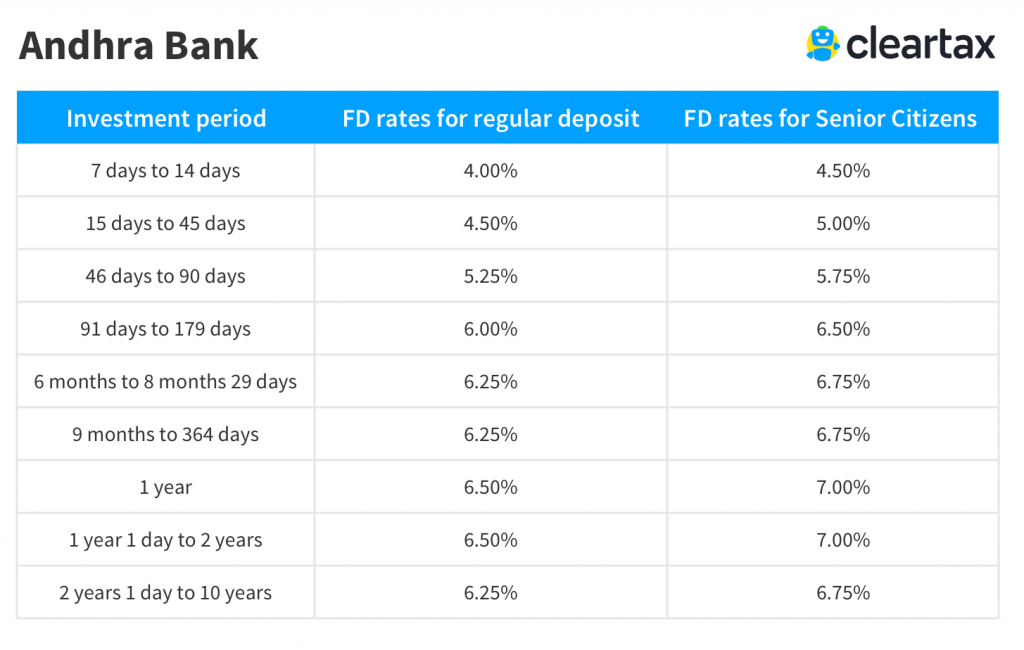

- Interest Rates - Deposit Interest Rates - Loans and Advances Interest Rates for NRIs Fees and Services Nomination Facilities Information regarding COVID - 19 Others.

- Other than this only following 5 banks offer higher than 3.5% interest rate: Bandhan Bank, Kotak Mahindra Bank, Lakshmi Vilas Bank, Ratnakar Bank and Yes Bank. The good news is most new age Small Finance Banks offer interest rate of 4% or higher on their savings account. Suryoday Small Finance Bank offers 7.25% for balance between Rs 1 to 10 Lakh.

Andhra Bank Savings Account Interest Rate Calculator

Andhra Bank Savings Account Interest Rate

Features:Andhra Bank Savings Account Interest Rate Per Month

Any Resident Individual - Single Accounts, Two or more individuals in Joint Accounts, Illiterate Persons, Visually Impaired persons, Purdanasheen Ladies, Minors, Associations, Clubs, Societies, etc.

What Is The Interest Rate In Andhra Bank

- Minimum balance requirement with or without cheque book facility:

Centres

Without Cheque Book (`)

With Cheque Book (`)

Metro

500

1000

Urban

500

1000

Semi Urban

250

500

Rural

100

250

- Interest is calculated on daily product basis and will be credited on quarterly basis in the months of April, July, October and January every year.

- Rate of interest upto 25Lacs and more than 25 lacs-3%p.a